How to Charge Sales Tax on Shopify

Read this blog post to find a method to collect tax from your customers in Shopify and comply with the taxation rules. 😇

If you are selling your products in multiple regions using Shopify platform, it is essential to follow the region’s government-approved sales tax slab. The consequences of not following the government’s taxation rules and regulations can lead to legal issues and affect your business progress.

Therefore, the Shopify store owners need to comply with the local tax regulations to avoid such circumstances. In this blog post, I will guide you on how to charge sales tax on Shopify.

How to Set Up Sales Tax in Shopify

Setting up taxes is an essential part of the Shopify launch checklist. First, you need to register your business with the local tax agencies to get your sales tax ID. After registering with relevant tax agencies, you can start setting up your sales tax for your Shopify store.

Now, wasting no more time, follow these steps to set up sales tax in Shopify:

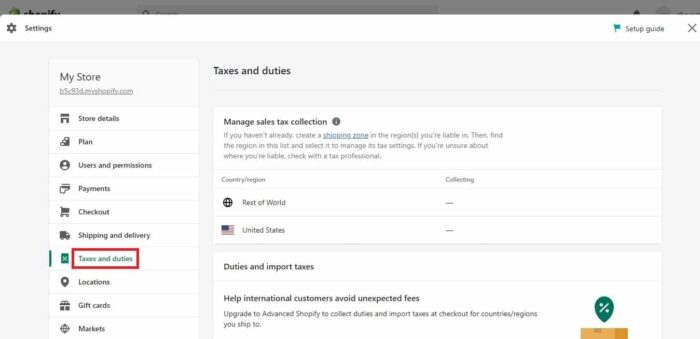

- Step 1: Log into Shopify admin and go to Settings > Tax and Duties.

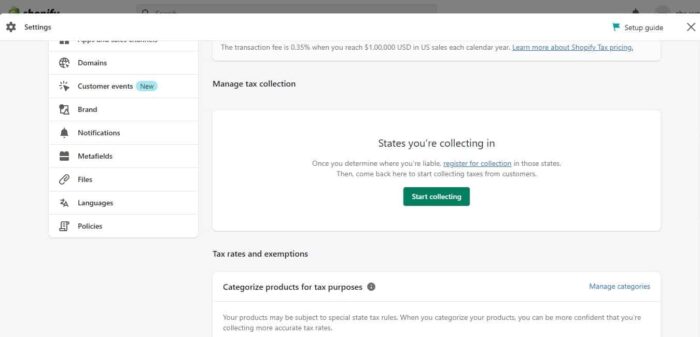

- Step 2: Scroll down to the Manage tax collection section and click on Start Collection.

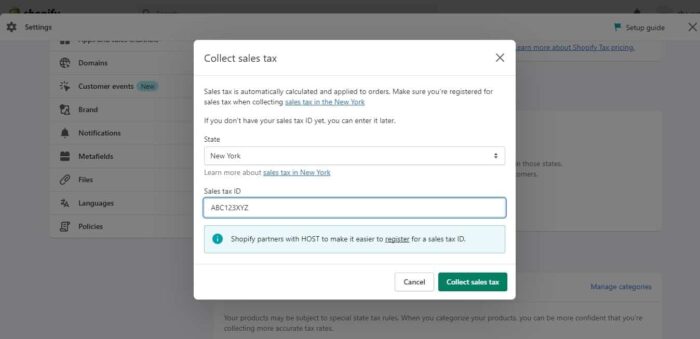

- Step 3: This is where you tell Shopify where to collect sales tax. Select the state you want to collect sales tax, enter your sales tax ID (you can enter it later if you don’t have one yet), and click on the Collect sales tax button. You can repeat this process to add another state.

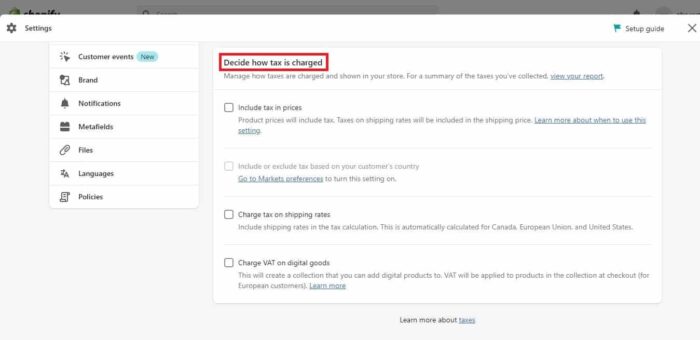

- Step 4: Go back to the Taxes and duties tab, scroll down, and you will find the Decide how tax is charged section. Here, you will find four options to choose from. You can tick multiple check boxes if required.

- Include tax in prices

- Include or exclude tax based on your customer’s country

- Charge tax on shipping rates

- Charge VAT on digital goods

In some countries/regions, the default tax rates of Shopify do not apply to certain products, like some essential products and certain types of children’s products, and might be exempt from the tax. In such cases, you can create tax overrides for certain products.

In some countries/regions, the default tax rates of Shopify do not apply to certain products, like some essential products and certain types of children’s products, and might be exempt from the tax. In such cases, you can create tax overrides for certain products.

Final Words

So now you know how to charge sales tax on Shopify for the country/region your business is located. I have explained all the steps as simply as possible to make it easy to understand. Hope you will find this blog post useful. 🚀

Frequently Asked Questions

1. Do I Need to Charge Sales Tax on Shopify?

Ans. Should you be charging sales tax on Shopify or not, it depends on the location where you will sell your products. If you are unsure about whether to charge, you can consult local tax professionals.

2. How Does Sales Tax Work on Shopify?

Ans. Many default sales tax rates are used in Shopify, which are regularly updated. If you wish to use default sales tax rates, confirm that the rates are accurate and legit. In some circumstances, you can also override them.

Create magnificent experiences for your customers using our Shopify Store Development Services.

Sanjay Jethva

Sanjay is the co-founder and CTO of Meetanshi with hands-on expertise with Magento since 2011. He specializes in complex development, integrations, extensions, and customizations. Sanjay is one the top 50 contributor to the Magento community and is recognized by Adobe.

His passion for Magento 2 and Shopify solutions has made him a trusted source for businesses seeking to optimize their online stores. He loves sharing technical solutions related to Magento 2 & Shopify.

Prev

Alternative to Magento 2 Deprecated Load, Save and Delete Methods

30+ Affiliate Marketing Statistics You Need to Know 2024

Next