How to Apply Indian GST in Magento

Goods and Service Tax is the largest tax reform in India. Introduced on July 01, 2017, it is compulsory for every business to follow the GST rules and Magento is no exception. Magento dominates E-commerce, and with the advent of GST in India, Magento store owners are looking for the ways to configure it in their stores. If you own a Magento store and are yet fumbling for GST implementation, you are at the right place. Read the tutorial to learn how to apply Indian GST in Magento with tax rules.

First of all, the store owners need to find the GST rates under which their products fall. Refer GST Rate Finder to decide the GST rates of your products. Once this task is done, proceed with the given method below.

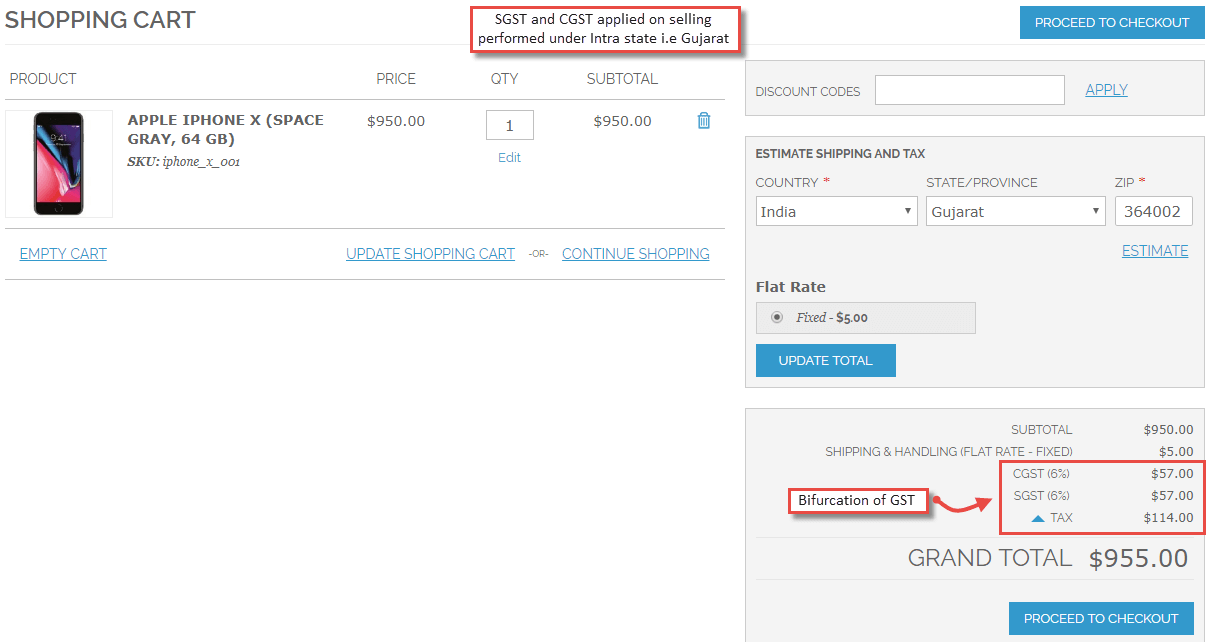

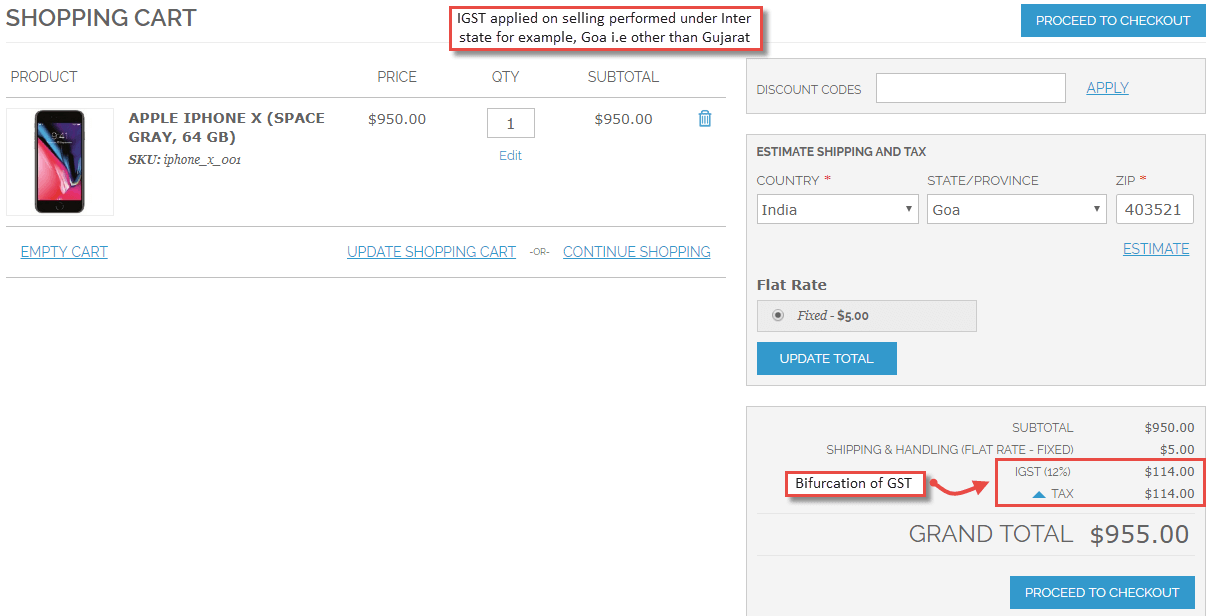

Here, in the blog, consider the GST rate as 12% and business origin as Gujarat state to better understand the steps. Business origin play vital role in calculating CGST-SGST, or IGST. If the selling is performed Intra-state i.e Gujarat to Gujarat, CGST (69%) and SGST (6%) will be applied and equally divided to make GST. However, if the selling is performed Inter-State i.e states other than Gujarat, IGST (12%) will be applied.

Now, let’s dig into the steps to apply GST in Magento.

Steps to apply Indian GST in Magento

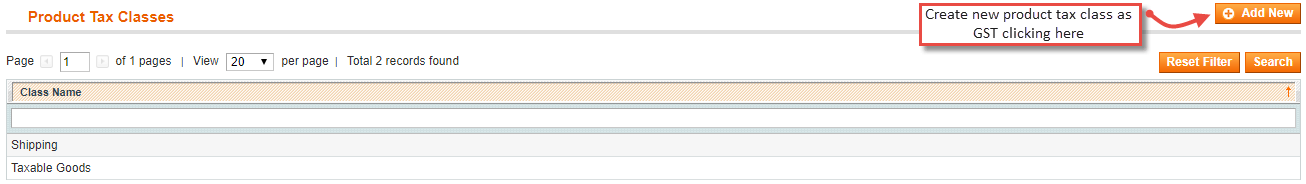

- First of all, navigate to Sales > Tax > Product Tax Classes and click Add New.

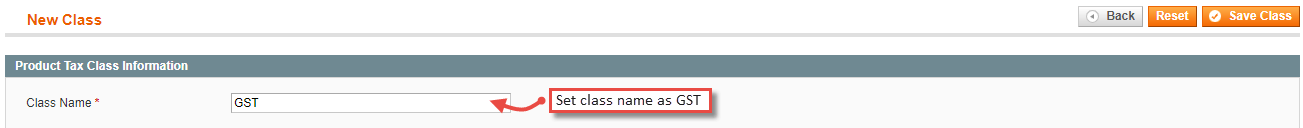

- Name the product tax class as GST to easily identify the tax class while creating tax rules and rates for all 3 SGST, CGST, and IGST.

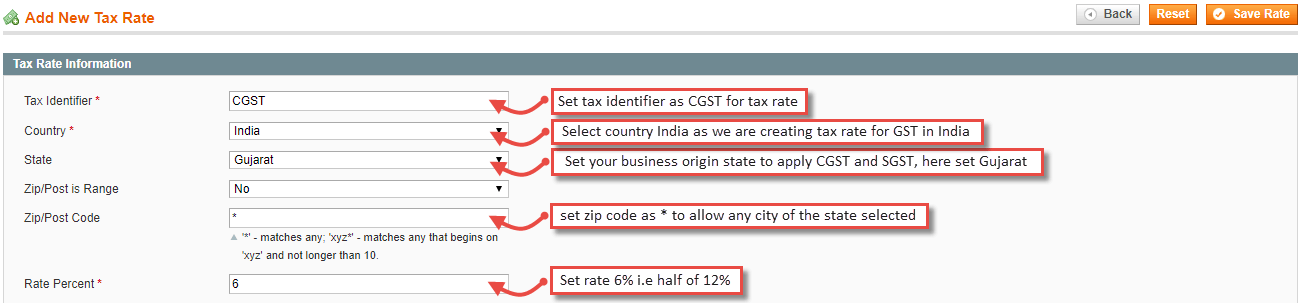

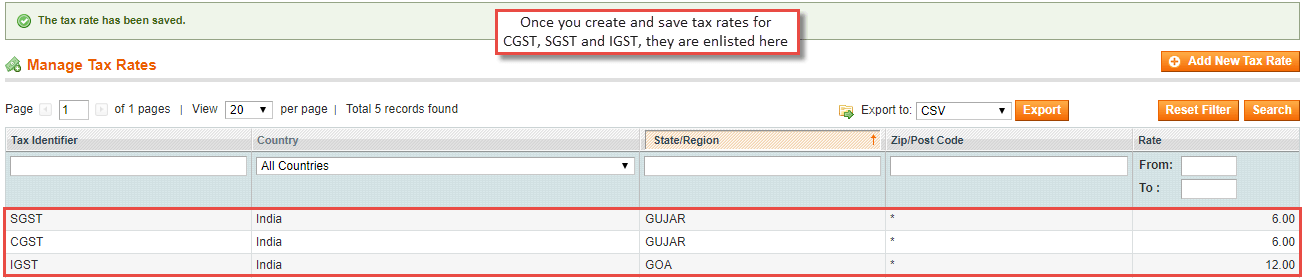

- Before creating tax rates, follow this guide to install states script to get auto state selection for Indian states. Now navigate to Sales > Tax > Manage Tax Zones & Rates to create tax rates for CGST, SGST, and IGST. While creating tax rates, set 6% of rate and Gujarat as the business origin for both CGST and SGST. And for IGST, you have to create 28 rates of 12% IGST for all the states other than Gujarat to make GST work for all the states of India. Click save once all the rates have been created.

- Once all the 3 tax rates are created, they can be seen enlisted under Sales > Tax > Manage Tax Zones & Rates.

- Whenever the selling is performed intra-state, SGST and CGST are equally divided into two halves of the whole rate of the GST, i.e., 6% to make the complete 12%.

As per the government rule, sellers have to bifurcate CGST, SGST and IGST separately in order details and invoices for every single order. To split CGST-SGST equally into two, you have to custom code as below.

Go to app/design/frontend/base/default/template/tax/checkout/tax.phtml and find the blow code at line number 54.

Replace the above code with this to bifurcate CGST-SGST on cart and checkout page.12345<?php if ($isFirst): ?><td <?php echo $this->getValueProperties()?> rowspan=" 1 <?php echo count($rates); ?>"><?php echo $_order->formatPrice($amount); ?></td><?php endif; ?>

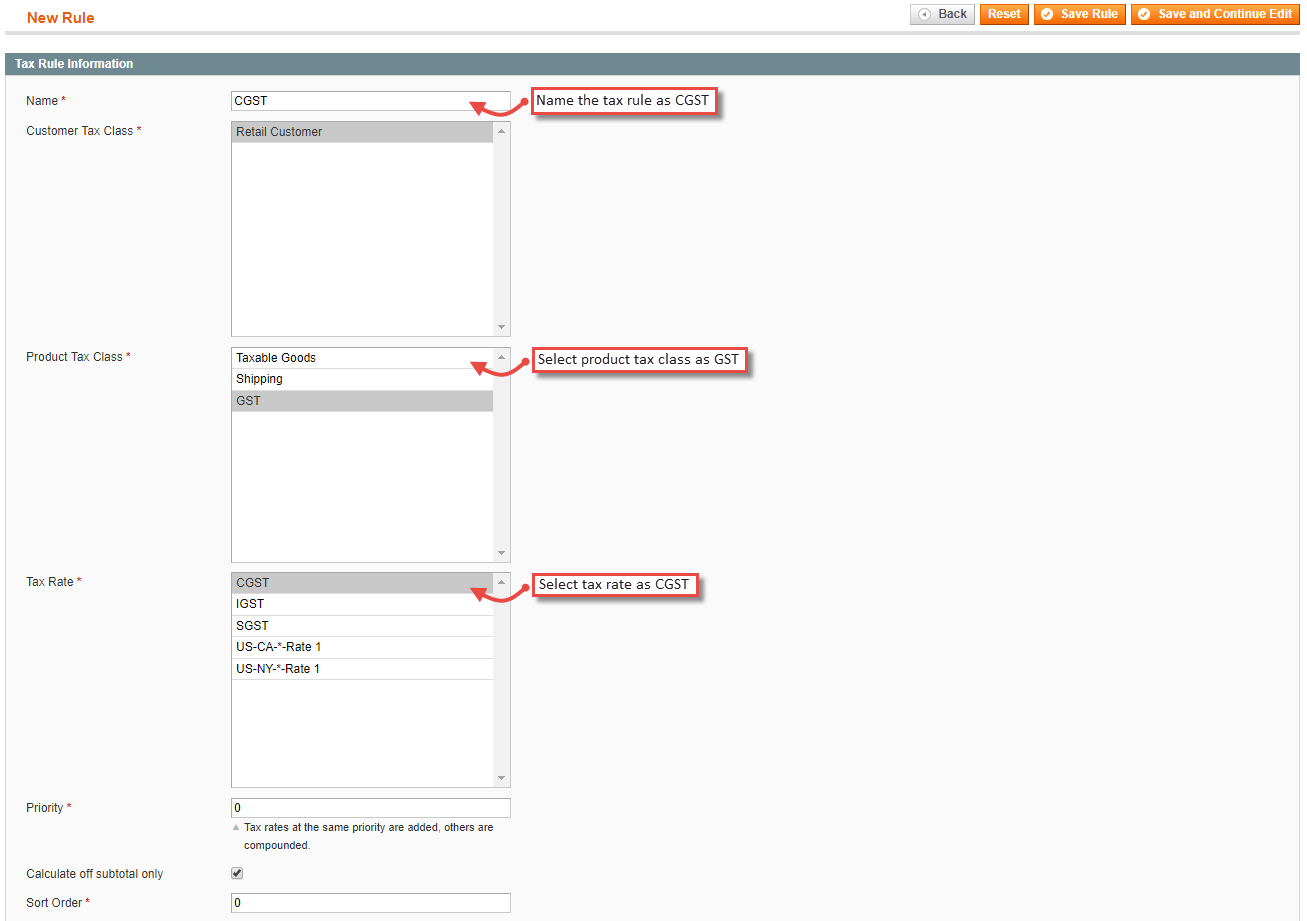

12345<?php //if ($isFirst): ?><td style="<?php echo $_style ?>" class="a-right" rowspan="1 <?php //echo count($rates); ?>"><?php echo $this->helper('checkout')->formatPrice($amount / ($percent/(float)$rate['percent'])); ?></td><?php //endif; ?> - Now create tax rules from Sales > Tax > Manage Tax Rules for all the 3 CGST, SGST and IGST. Select product tax class as GST and tax rate for each of them respectively as created.

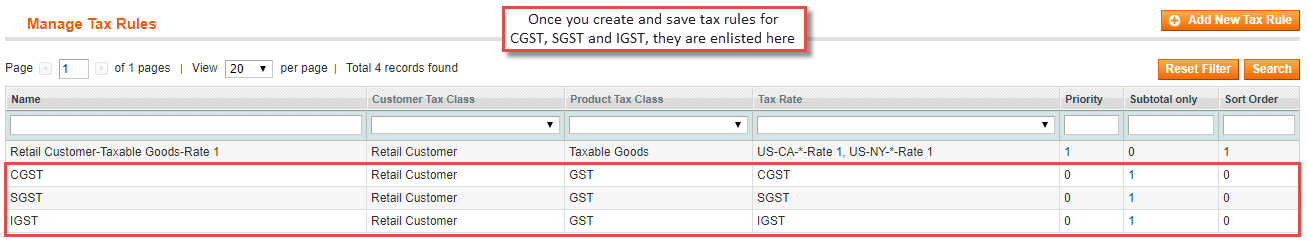

- Once tax rules are created and saved, they can be seen enlisted under Sales > Tax > Manage Tax Rules.

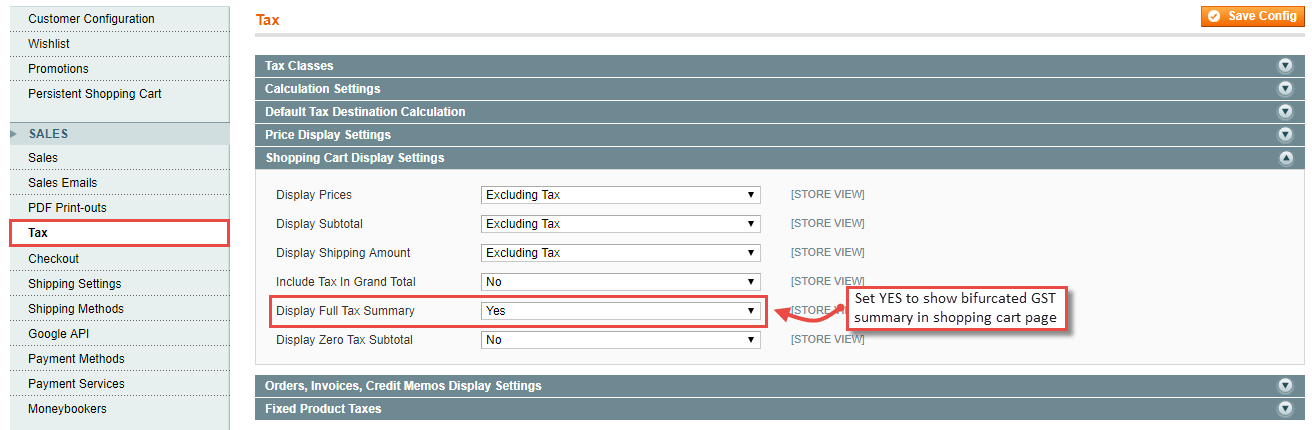

- Enable the “Display Full Tax Summary” in System > Configuration > Sales > Tax > Shopping Cart Display Settings to show detailed tax summary with the bifurcation of CGST-SGST and IGST.

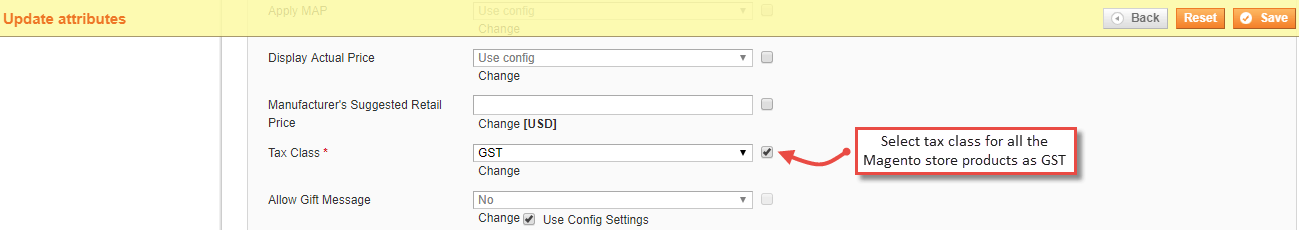

- To assign tax class as GST to all the products, simply go to Catalog > Manage Products, select all the products, select Update Attributes from the Action drop-down, go to Tax Class, tick Change and set GST from the drop-down and save.

- To test the above steps and proper implementation of GST in Magento, add a product to cart and select the country as India and state as Gujarat. You will see the SGST and CGST tax rate applied on order.

- To test the IGST, select a different state in the above step. The below image shows the calculation of IGST when Goa state is chosen.

Follow all these steps to apply Indian GST in Magento! But to make it work for all the Indian states, you have to create 28 IGST tax rates which are really a tiresome task. Moreover, the process is more complicated if you have products which belong to multiple tax rate slabs.

If you are not really ready to try your hands on creating these many tax rates and put yourself in trouble, No Worries :), you can have a look at our Magento GST India extension which is the ultimate module for auto calculation of Indian GST in your Magento store! Try our Free GST Calculator to calculate the GST rates more accurately in a precise way. Adding GST in Magento using this extension is as easy as ABC, just take a look at the features the extension serve and try the live demo to test before you buy!

Let me know which of the choices you will prefer to Apply Indian GST in Magento. In either case, if you stuck somewhere, I’ll be happy to help as always! 🙂

Award 5 stars to my GST guide if found helpful!

Sanjay Jethva

Sanjay is the co-founder and CTO of Meetanshi with hands-on expertise with Magento since 2011. He specializes in complex development, integrations, extensions, and customizations. Sanjay is one the top 50 contributor to the Magento community and is recognized by Adobe.

His passion for Magento 2 and Shopify solutions has made him a trusted source for businesses seeking to optimize their online stores. He loves sharing technical solutions related to Magento 2 & Shopify.

![Magento vs Opencart – Which One is Best For You? [2022]](png/magento-vs-opencart-%e2%80%93-which-one-is-best-for-you.png)

4 Comments

I was looking for authoritative content on “How to apply for GST” and this article accurately explains the concepts relating to the same. It is an understandable, informative and a very well written content piece.

Dear Friend,

I am moving my Homoeopathy store to Magento 2.2 from Opencart. All the price entered on the store are inclusive of GST.

Ex. MRP is 250 inclusive all tax.

I purchased in 220 and paid GST on 220.

I am selling in 240 – all tax included. Will this above setting work?

Will it display breakup on 240?

Please guide.

Thanks,

Niraj

Hi Niraj,

You are checking in the wrong solution. Try implementing the solution https://meetanshi.com/blog/apply-indian-gst-in-magento-2/ which is for Magento 2

This is a wonderful read.